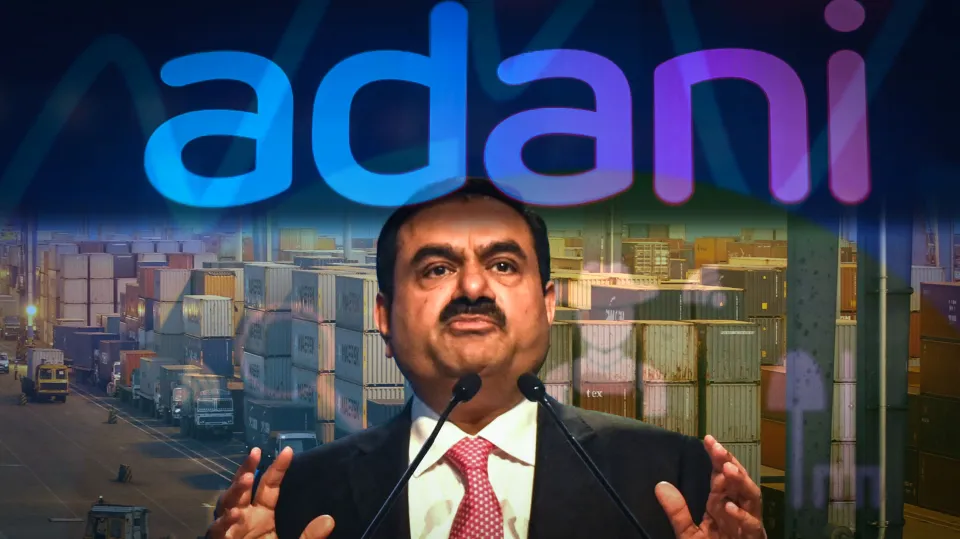

Adani Group Refutes Claims of $310 Million Fund Freeze by Swiss Authorities

~ By Sujeet Rawat

Sep 13 2024, 05:27 PM

The Adani Group has denied allegations made by Swiss media outlet Gotham City and US-based Hindenburg Research that Swiss authorities have frozen $310 million in multiple Swiss bank accounts linked to the Group as part of a money laundering investigation. Adani calls the allegations "preposterous, irrational, and absurd," asserting its compliance with all legal and regulatory requirements.

The Adani Group has strongly refuted recent claims that Swiss authorities have frozen over $310 million in funds across multiple Swiss bank accounts linked to the conglomerate, as part of a money laundering and securities forgery investigation. These allegations were reported by Swiss investigative news website Gotham City and amplified by US-based short-seller Hindenburg Research.

According to the Gotham City report, the investigation dates back to 2021 and involves financial activity tied to investment structures in offshore tax havens, including the British Virgin Islands (BVI), Mauritius, and Bermuda, which allegedly held substantial amounts of Adani stocks. The report suggests that Swiss authorities have sequestered funds in six Swiss banks linked to entities associated with the Adani Group.

Adani Group's Response

In a statement, the Adani Group dismissed the allegations as "preposterous, irrational, and absurd," and claimed that this was another attempt by a coordinated group to harm its reputation and market value. The Group clarified that it has no involvement in any Swiss court proceedings, nor have any of its company accounts been subject to sequestration by any authority.

“The Adani Group has no involvement in any Swiss court proceedings, nor have any of our company accounts been subject to sequestration by any authority,” the statement read. “Furthermore, even in the alleged order, the Swiss court has neither mentioned our group companies nor have we received any requests for clarification or information from any such authority or regulatory body. We reiterate that our overseas holding structure is transparent, fully disclosed, and compliant with all relevant laws. These allegations are clearly preposterous, irrational, and absurd.”

Context and Ongoing Allegations

The Adani Group's response follows a series of allegations and reports aimed at the conglomerate. In January 2023, Hindenburg Research accused the Group of stock-price manipulation, undisclosed related-party transactions, and breaches of public shareholding norms. The Adani Group has consistently denied these accusations. More recently, in August 2023, Hindenburg alleged that Securities and Exchange Board of India (SEBI) Chairperson Madhabi Puri Buch and her husband held investments in offshore entities tied to a fund backed by Vinod Adani, the brother of billionaire Gautam Adani. Both Buch and SEBI denied these allegations.

Hindenburg Research, known for its critical reports on various corporations, posted on its X (formerly Twitter) account on September 12, 2024: "Swiss authorities have frozen more than $310 million in funds across multiple Swiss bank accounts as part of a money laundering and securities forgery investigation into Adani, dating back as early as 2021. Prosecutors detailed how an Adani frontman invested in opaque BVI/Mauritius & Bermuda funds that almost exclusively owned Adani stocks, according to newly released Swiss criminal court records reported by Swiss media outlet."

The Group's Stand on Transparency

Adani Group reiterated its commitment to transparency and compliance with all legal and regulatory requirements, stating, "We strongly condemn this effort and urge you to refrain from publishing this story. Should you decide to proceed, we request that you include our statement in full." The Group has maintained that its overseas holding structure is transparent and fully compliant with all relevant laws, rejecting any involvement in activities that would prompt such investigations.

ALSO READ| Wall Street Gains Amid Speculation of Fed Rate Cuts: Key Insights for Investors

As the controversy continues, Adani Group remains steadfast in its denial of the allegations and is prepared to defend its stance against any further claims. The ongoing scrutiny from various entities has raised questions about transparency and regulatory compliance within the Indian conglomerate, although Adani Group maintains that it adheres to all legal obligations.

The situation remains fluid, with both Swiss and Indian authorities yet to issue a definitive public statement regarding the allegations or the ongoing investigation.

[Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial or legal advice. Readers should conduct their research or consult with a professional before making any investment decisions.]

Recent Posts

Trending Topics

Top Categories

QUICK LINKS

Copyright © 2024 Arthalogy.com. All rights reserved.