Operation Sindoor and Stock Market Reactions: What Investors Should Know

~ By Sujeet Rawat

May 7 2025, 05:38 AM

India launches Operation Sindoor after the Pahalgam attack, striking terror camps in PoK. Markets may react sharply as geopolitical tensions rise globally.

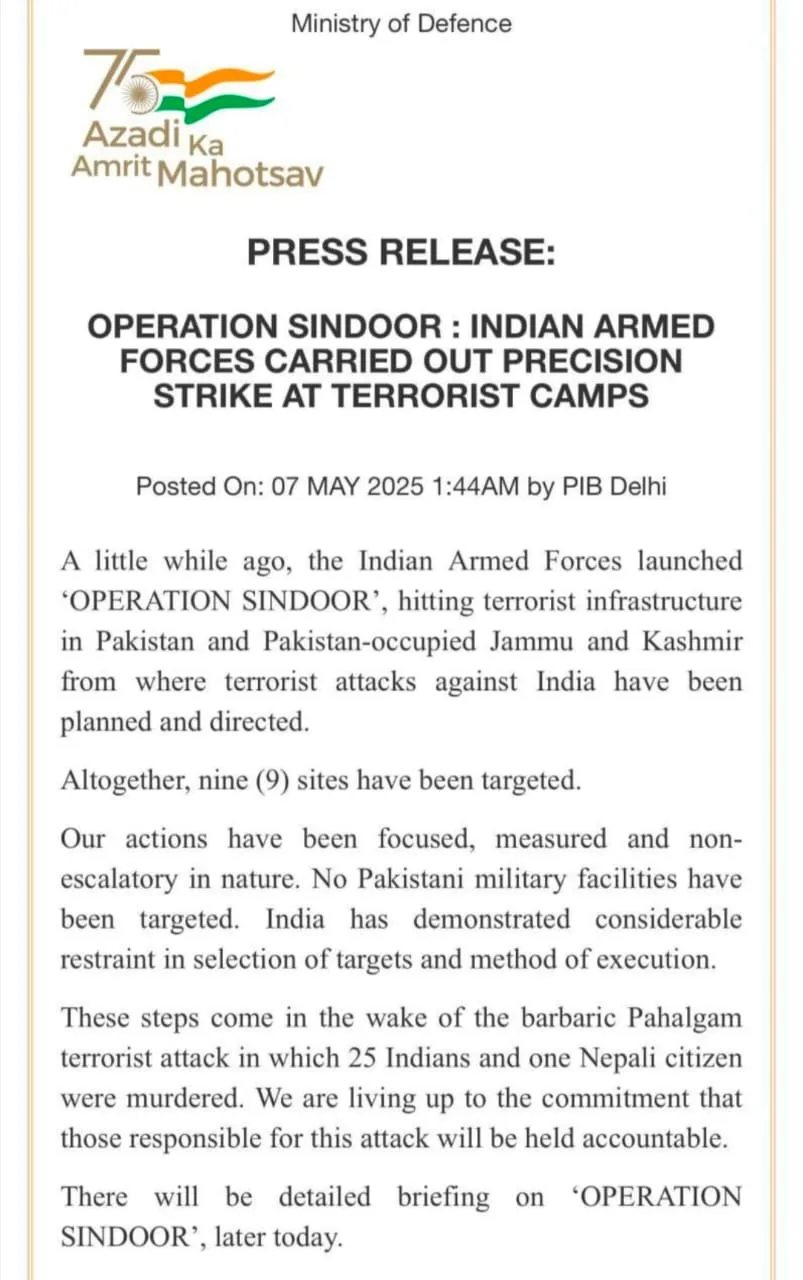

As geopolitical tensions flare up following India’s decisive response to the Pahalgam terror attack, Dalal Street braces for potential market reactions. Early Wednesday morning, under Operation Sindoor, the Indian Armed Forces launched precision missile strikes on nine terrorist locations across Pakistan and Pakistan-occupied Kashmir(PoK)—including Bahawalpur, a known Jaish-e-Mohammad stronghold.

This comes just two weeks after a brutal terror attack in Pahalgam claimed the lives of 25 Indian nationals and one Nepali citizen, sparking public outrage. The government confirmed multiple successful strikes, with early reports indicating that at least 12 terrorists were killed and over 50 injured.

While the financial markets remain closed at the time of writing, analysts expect heightened volatility once trading begins, with defence and aerospace stocks likely to rally. However, broader indices such as the Sensex and Nifty could show caution, depending on how the geopolitical situation evolves.

Investors and market participants are advised to monitor developments closely, as any further escalation or diplomatic response may influence investor sentiment throughout the trading day.

Why Operation Sindoor Was Launched?

Operation Sindoor was not a spontaneous military decision—it was a calculated and strategic retaliation by India following one of the deadliest terror attacks in recent years. On April 23, 2025, terrorists ambushed a convoy in Pahalgam, Jammu & Kashmir, resulting in the deaths of 25 Indian nationals and one Nepali national. The attack sparked widespread outrage across the country, with growing public demand for a strong and clear military response.

Watch: https://x.com/arthalogy/status/1919878853251445205?t=cXaGAcdcgppUtTkCVinZiQ&s=08

Investigations traced the attack’s origin to terror camps operating from across the Line of Control (LoC), particularly in Pakistan and Pakistan-occupied Kashmir (PoK). Among the key locations identified was Bahawalpur, a city long associated with the operations of Jaish-e-Mohammad, the terror outfit suspected of orchestrating the Pahalgam assault.

According to intelligence reports, these camps were not just providing logistical support but also directly planning and directing attacks on Indian soil. After gathering concrete evidence, Indian defence officials finalised plans for a precision strike to dismantle these facilities and send a strong deterrent signal.

The government maintained a high level of secrecy before launching nine simultaneous strikes, emphasising that this action was defensive in nature and aimed specifically at terror infrastructure. Diplomatic channels were also activated immediately after the strikes to brief major global players, including the US, UK, Russia, UAE, and Saudi Arabia, about the operation’s intent and justification.

Pakistan’s Counter-Attack: Early Response and Regional Impact

In the hours following India’s precision strikes under Operation Sindoor, Pakistan initiated a swift counter-response, both militarily and diplomatically. Reports began surfacing of heavy exchange of fire along the Line of Control (LoC), particularly near Kotli in Pakistan-occupied Jammu & Kashmir (PoJK). Unverified sources have suggested casualties among Pakistani forces, although Islamabad has released no official statement.

Tensions escalated further after visuals emerged claiming to show a Pakistani F-16 fighter jet downed in the Pampore region of Kashmir. While the Indian Armed Forces have not issued a formal confirmation, the footage circulated widely on social media, fueling public sentiment and speculation.

Simultaneously, Pakistan’s Foreign Office strongly condemned India’s strikes, labelling them a “flagrant violation of sovereignty” and warning of consequences. Diplomatic efforts were immediately launched, with Pakistan seeking support from international allies and raising the matter in global forums, including the United Nations.

Military analysts believe that Pakistan’s immediate goal is to project strength without triggering a full-scale war. However, airspace disruptions and increased military presence on both sides signal a tense standoff that could persist, at least in the short term.

From a financial perspective, any sustained escalation could affect foreign investor sentiment, trigger short-term currency fluctuations, and increase volatility in sectors sensitive to geopolitical risks, such as airlines, oil & gas, and defence.

Global Reactions: Support Pours In

In the hours following Operation Sindoor, several key international players responded swiftly, signalling their positions on India’s preemptive counter-terrorism strike:

- 🇮🇱 Israel: A strong statement of solidarity came from Israel, affirming its support for India’s right to defend its sovereignty. "Israel stands with Bharat in its fight against terrorism," said a senior Israeli official on X (formerly Twitter), echoing long-standing defence cooperation between the two nations.

- 🇺🇸 United States: U.S. officials were briefed promptly by Indian counterparts. While Washington urged restraint and regional stability, it also acknowledged India’s "legitimate right to protect its citizens."

- 🇬🇧 United Kingdom, 🇸🇦 Saudi Arabia, 🇦🇪 UAE, and 🇷🇺 Russia were also contacted by Indian diplomats. called for calm while acknowledging India’s concerns regarding repeated cross-border threats.

These swift diplomatic efforts reflect India's intention to contain escalation while asserting its national security posture. The broad support, especially from countries actively fighting terrorism, helps reinforce India’s global standing as a responsible yet firm actor.

Effect on the Share Market: Volatility Ahead?

With markets yet to open, early indicators suggest that Operation Sindoor may cast a significant shadow over Dalal Street’s mood in the short term. Historically, geopolitical tensions—especially those involving military conflict—trigger knee-jerk reactions in equities, particularly in sectors exposed to global risk and currency fluctuations.

If tensions escalate further, we could see:

- Defence sector stocks rallying, backed by optimism around increased government spending and renewed investor interest.

- Aviation and tourism stocks declining due to airspace closures around Srinagar, Jammu, Leh, and surrounding sectors, as confirmed by IndiGo and Air India.

- Energy sector volatility, as oil prices might spike amid fears of regional instability impacting crude supply chains.

- Broader indices like Sensex and Nifty50 may open in the red, reflecting cautious sentiment among institutional investors and foreign portfolio investors (FPIs).

- INR weakening temporarily against the US Dollar, a common reaction to external security shocks.

However, if the situation remains contained and no further escalations occur, the market might recover by mid-week, driven by fundamentals and earnings optimism in other sectors.

[Disclaimer: The information provided in this blog post is based on publicly available data. For continuous news and updates, join our social media platforms and stay connected with us for real-time information. ]

Recent Posts

Trending Topics

Top Categories

QUICK LINKS

Copyright © 2024 Arthalogy.com. All rights reserved.