Zerodha Reports 62% Profit Growth to ₹4,700 Crore in FY24

~ By Sujeet Rawat

Sep 25 2024, 04:13 PM

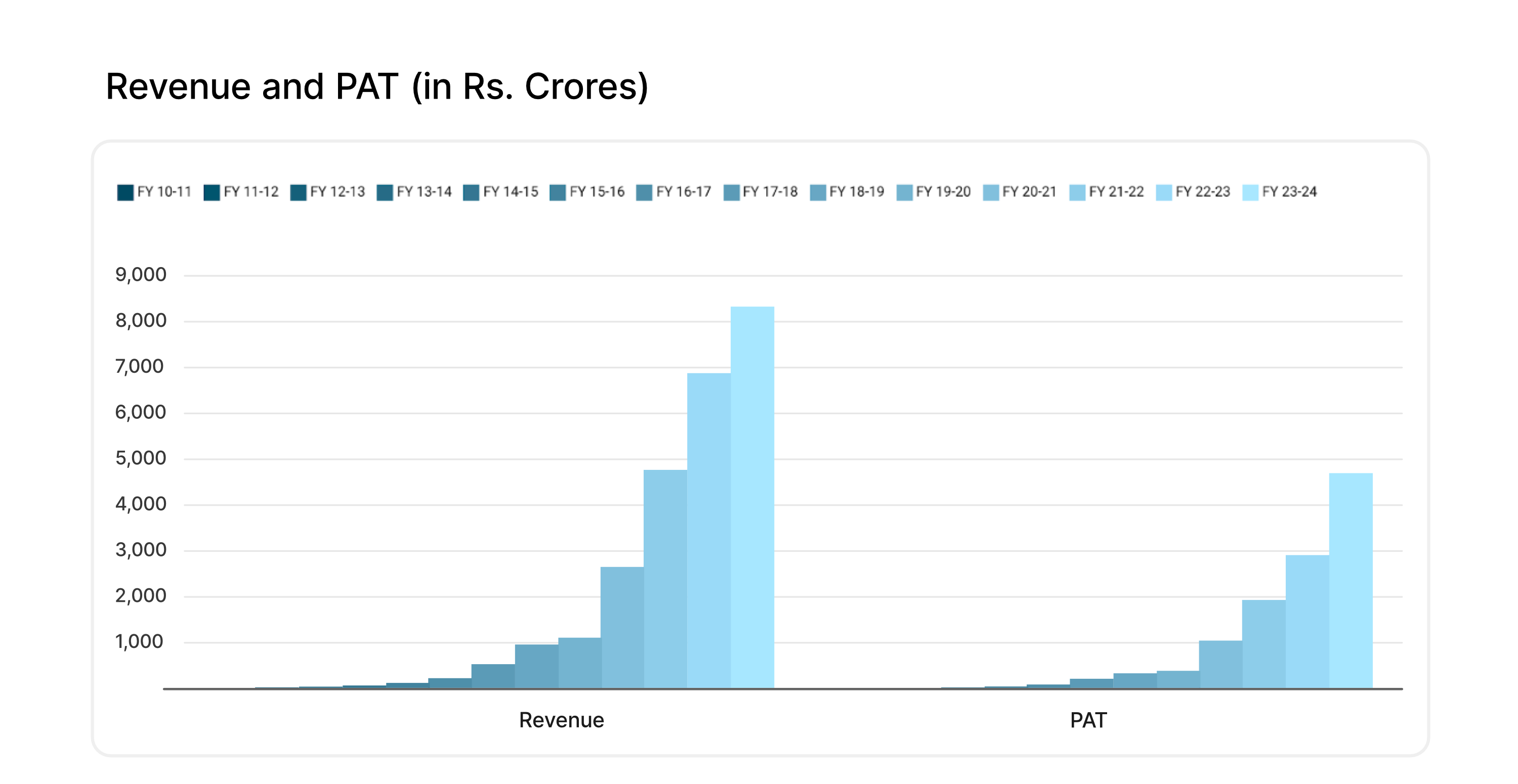

Zerodha, India's largest discount stockbroker, has reported a 62% growth in profit, reaching ₹4,700 crore in FY24, while revenue increased by 21% to ₹8,320 crore. The surge in profits is attributed to the company's growing customer base and high operating margins, which stood at 57% and could touch 69% when unrealized gains are factored in. CEO Nithin Kamath noted that while the company continues its robust financial performance, new regulatory changes, particularly concerning futures and options (F&O) trading, could impact profitability in FY25. Zerodha’s leadership in the brokerage sector remains strong, but future growth may slow due to market uncertainties and increased competition from rivals like Groww. Despite potential challenges, Zerodha continues to focus on innovation and maintaining its status as one of the safest brokers to trade within India.

Zerodha, India’s largest discount stockbroker, has achieved another remarkable financial milestone in FY24. The company reported a staggering 62% increase in profit, reaching ₹ 4,700 crore, up from ₹ 2,907 crore in FY23. The company's revenue also grew by 21%, reaching ₹ 8,320 crore, as announced on September 25, 2024. Zerodha’s continued profitability highlights its resilience and adaptability in an increasingly competitive and regulated market.

CEO Nithin Kamath, in a blog post, attributed this growth to the company's strong operational performance and a steady increase in its active client base. Despite challenges in the broader financial landscape, Zerodha has managed to maintain its leadership position in the stockbroking sector. Kamath also noted that these impressive profits do not take into account approximately ₹1,000 crore in unrealized gains from its investment portfolio. If these gains were included, Zerodha’s operating margins could rise from the current 57% to a whopping 69%, making it one of the most profitable companies in the tech and financial sectors.

Financials

~Picture taken from Zerodha's website

Zerodha’s margins are now comparable to some of the largest global tech giants, such as Nvidia, which reported an operating margin of 64%. The company’s robust performance is driven by its ability to manage customer funds securely while maintaining low operational costs. Kamath emphasized that Zerodha's prudent financial management makes it one of the safest brokers to trade within India. This level of profitability sets Zerodha apart in a sector where many players struggle to maintain consistent margins due to regulatory pressures and market volatility.

However, the road ahead may not be as smooth for Zerodha. Regulatory changes set to be implemented in FY25 could significantly impact its bottom line. One of the most concerning changes is the potential limitation on futures and options (F&O) trading, which has been a major revenue driver for Zerodha and other discount brokers. Currently, the brokerage earns between 65% and 85% of its revenue from F&O trading. The new regulations, introduced by the Securities and Exchange Board of India (SEBI), are aimed at curbing excessive speculative trading and could reduce Zerodha’s topline by 30% to 50%.

In addition to these regulatory changes, SEBI is also expected to impose further restrictions on volume-based rebates from exchanges to brokers. This could affect Zerodha’s ability to maintain its competitive pricing model, which has been one of the key factors behind its rapid growth. Kamath acknowledged that the uncertain regulatory environment poses a significant challenge for the company’s future growth prospects. He noted that while Zerodha is prepared for these changes, they could lead to a temporary decline in revenue in the coming financial year.

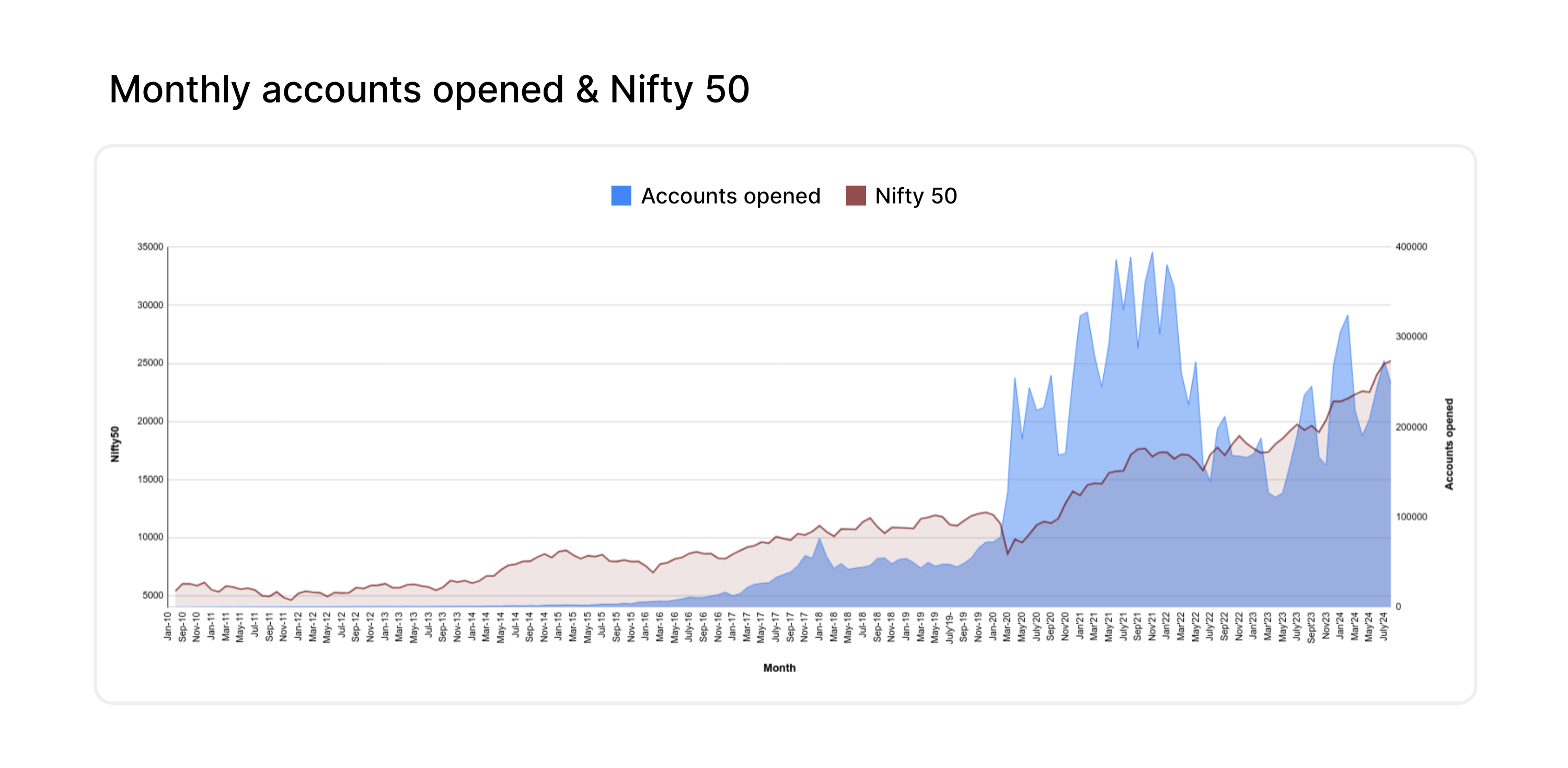

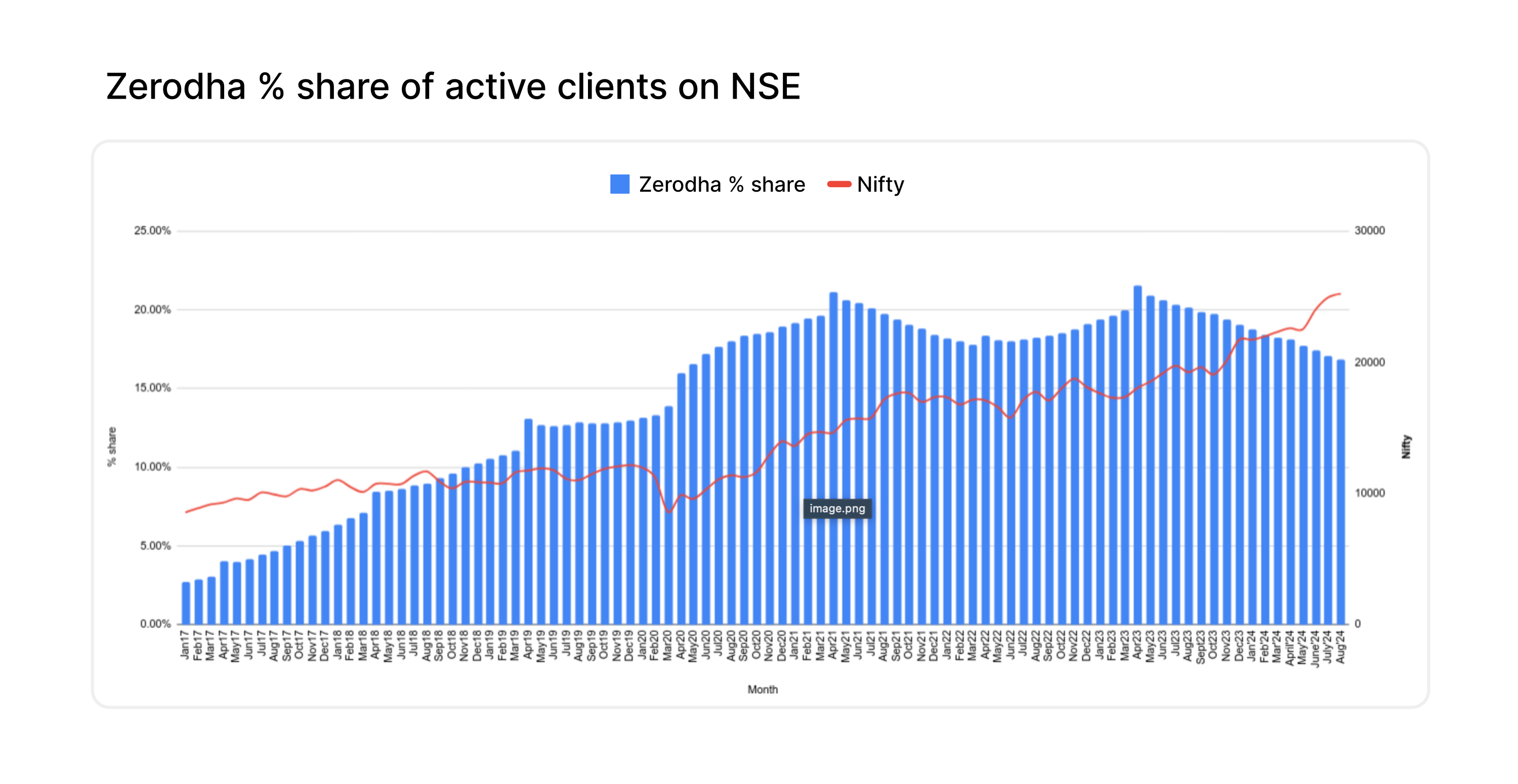

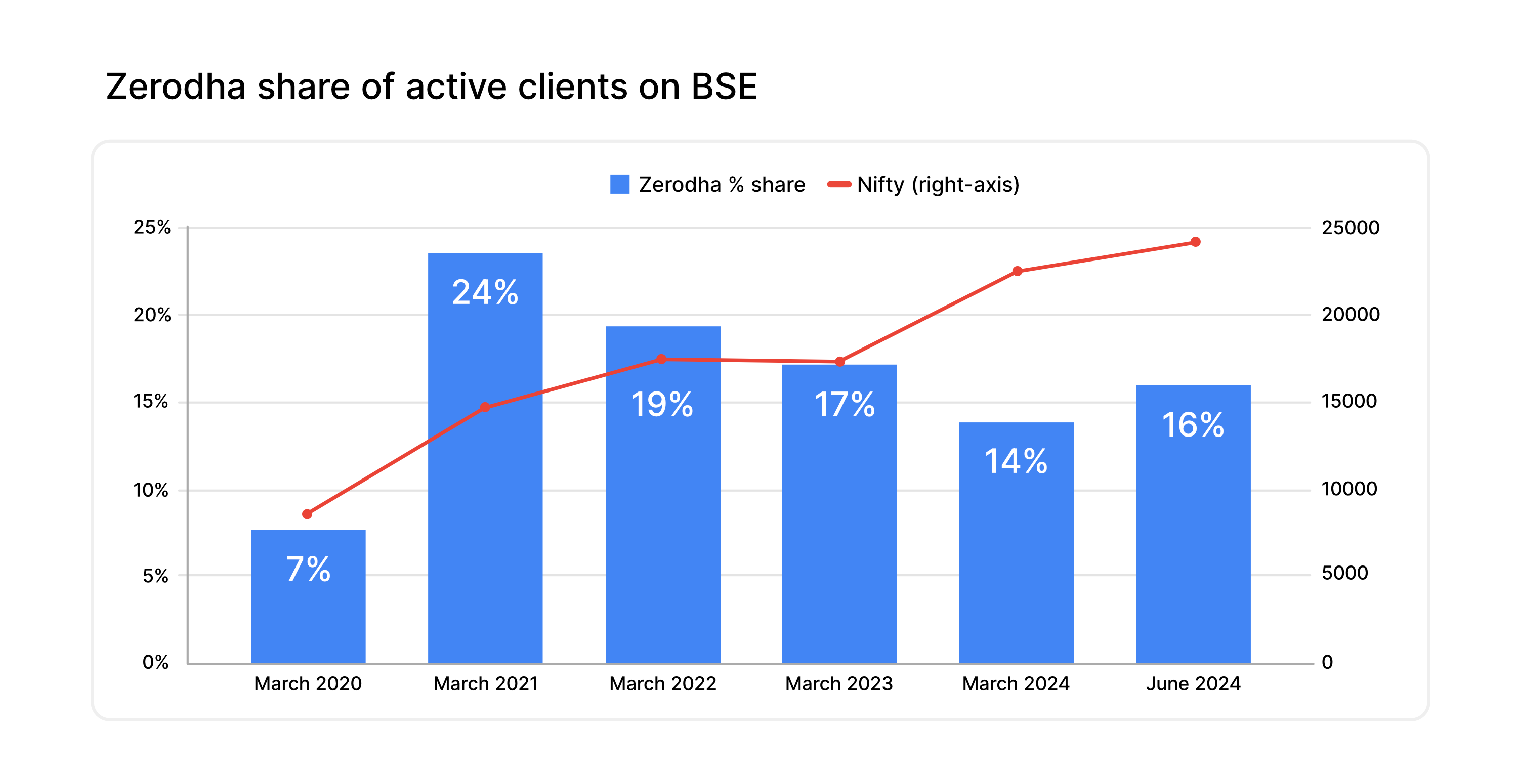

Despite these concerns, Zerodha remains optimistic about its long-term prospects. The company has been continuously innovating to stay ahead of its competitors. Over the past three years, Zerodha has seen consistent profitability, thanks to its customer-centric approach and its ability to adapt to changing market conditions. The company’s active client base has grown steadily, although its pace of growth has slowed in comparison to competitors like Groww and Angel One.

Groww, one of Zerodha’s closest competitors, has been rapidly expanding its client base and now boasts over 1.2 crore active clients. Angel One, another major player in the discount brokerage space, also reported strong financials for FY24, with a profit of ₹4,272 crore. While Zerodha remains the largest broker in terms of active clients, its market share could face pressure from these rising competitors, especially as regulatory changes reshape the brokerage landscape.

READ| KRN Heat Exchanger IPO Date, Price, GMP Today, Key Details, Review

Zerodha has also faced some internal challenges that have impacted its client acquisition. The company recently reversed its decision to waive account opening fees, a move that initially slowed down new client sign-ups. Kamath admitted that this policy change was a mistake and noted that Zerodha is now refocusing its efforts on attracting new clients while retaining its existing customer base.

Looking ahead to FY25, Kamath expressed cautious optimism. While acknowledging that the regulatory landscape presents significant challenges, he emphasized that Zerodha is well-positioned to weather the storm. The company’s strong financial foundation and its commitment to innovation will be crucial in maintaining its market leadership. Kamath also hinted that Zerodha may explore new revenue streams to mitigate the impact of regulatory changes, although he did not provide specific details.

Zerodha’s ability to remain profitable in the face of these headwinds will largely depend on its adaptability and its capacity to continue delivering value to its clients. The company has consistently emphasized its commitment to customer safety and has been proactive in managing the risks associated with its business model. Kamath reassured clients that Zerodha’s financial health remains strong, making it one of the most secure brokers in the Indian market.

As the financial year progresses, all eyes will be on how Zerodha navigates the challenges posed by new regulations and increased competition. The company’s strong performance in FY24 provides a solid foundation, but the true test will come as it adapts to the evolving regulatory environment. With its innovative approach and commitment to financial prudence, Zerodha is well-equipped to maintain its leadership position in the discount brokerage space, even as the industry undergoes significant changes.

ALSO READ| Israeli Airstrike Kills Hezbollah Commander Ibrahim Qubaisi, Escalating Israel-Hezbollah Conflict

Other Parameters

~Pictures taken from Zerodha's website

In conclusion, Zerodha’s FY24 results underscore its resilience and strength in a competitive market. The company's impressive profit growth and high operating margins are a testament to its efficient business model and its ability to navigate market challenges. However, the future remains uncertain, with regulatory changes and increased competition potentially impacting its growth trajectory. Zerodha’s focus on innovation, client safety, and adaptability will be key to its continued success in the coming years.

[Disclaimer: This article is based on publicly available financial data and regulatory reports. The information provided is for general informational purposes and does not constitute financial advice. Readers are encouraged to conduct their own research or consult with a professional before making any investment decisions.]

Recent Posts

Trending Topics

Top Categories

QUICK LINKS

Copyright © 2024 Arthalogy.com. All rights reserved.